The latest information about support for self-employed individuals during COVID-19 outbreak - 30th March 2020

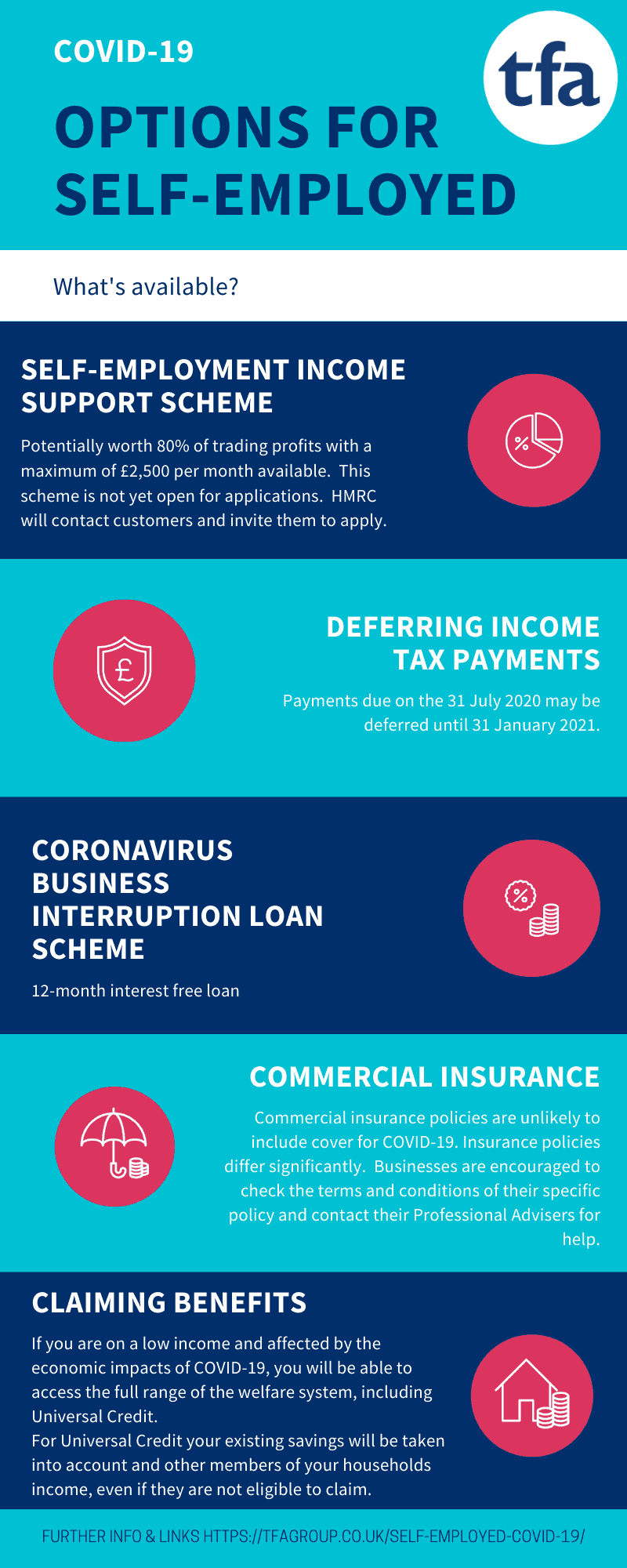

Self-employment Income Support Scheme

Potentially worth 80% of trading profits with a maximum of £2,500 per month available. This scheme is not yet open for applications. HMRC will contact customers and invite them to apply.

Commercial Insurance

Commercial insurance policies are unlikely to include cover for COVID-19. Insurance policies differ significantly. Businesses are encouraged to check the terms and conditions of their specific policy and contact their Professional Advisers for help.

Deferring Income Tax Payments

Payments due on the 31 July 2020 may be deferred until 31 January 2021.

Claiming Benefits

If you are on a low income and affected by the economic impacts of COVID-19, you will be able to access the full range of the welfare system, including Universal Credit.

For Universal Credit your existing savings will be taken into account and other members of your households income, even if they are not eligible to claim.

Universal Credit helpline is 0800 328 5644