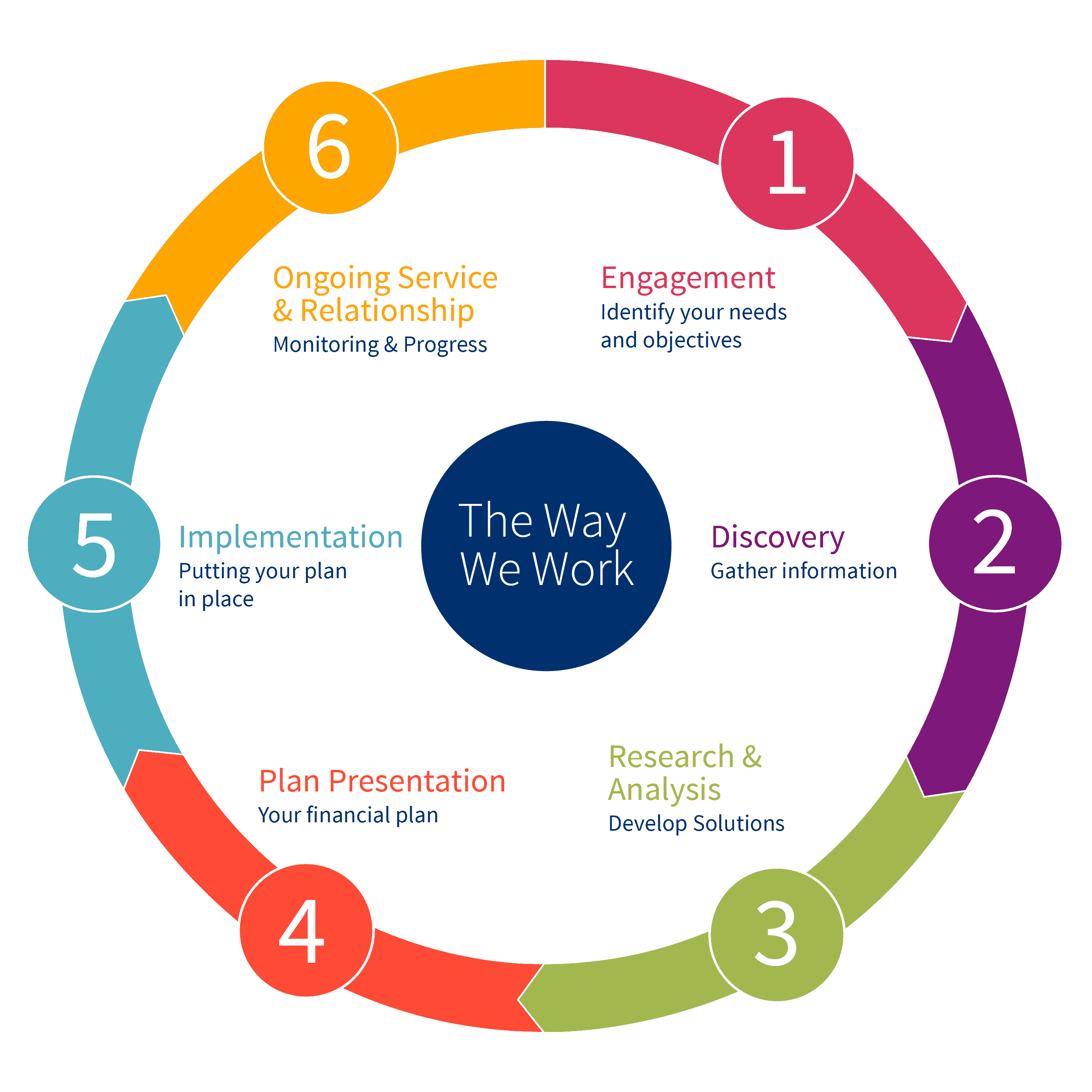

As leading independent financial advisers you would expect us to take a professional approach to the way in which we dispense our advice.

At TFA our advisers will take you through a carefully designed financial planning process so that you know exactly what is happening at each stage.

Step 1 – Engagement

Identifying your needs and objectives

We will have an introductory meeting to fully explain how our service works, identify your primary financial needs and objectives, answer any questions, agree the work to be completed and our payment terms.

Step 2 – Discovery

Gathering Information

Once we have agreed to work together we will gather your financial information to provide a comprehensive and detailed picture of your circumstances and confirm your objectives.

Step 3 – Research & Analysis

Developing Solutions

With all your information to hand, we will research and select products to construct our solutions and meet your objectives. This Financial Plan will include your financial position, your objectives and our written recommendation.

Step 4 – Plan Presentation

Your Financial Plan

We will meet and explain the plan to you. It will set out specific and realistic recommendations that are designed to achieve your objectives over an agreed time period.

Step 5 – Implementation

Putting your Financial Plan in place

Having agreed your Financial Plan, we will commence work on implementing our recommendations to you. At this point you can relax in the knowledge that we will be taking care of all the necessary final steps to turn your Financial Plan into a reality.

Step 6 – Ongoing Service & Relationship

Monitoring and Progress

Where on-going service is agreed, your adviser will help you review and amend your Financial Plan to make sure it remains on track to achieve your objectives. Reviews will take account of any changes in your personal circumstances, financial market conditions and relevant legislation.