What you need to know

The Chancellor of the Exchequer, Kwasi Kwarteng, announced during his Mini-Budget Growth Plan 2022 statement on Friday 23 September 2022 changes to the Stamp Duty Land Tax in England and Northern Ireland.

The Chancellor reiterated the government is committed to an economy based on high growth and low tax, to help people keep more of the money they earn and drive business investment as a re-sult.

To help achieve these aims, the government is reforming Stamp Duty Land Tax by doubling the level at which people begin paying this from £125,000 to £250,000.

This government, Mr Kwarteng commented, is also committed to helping first-time buyers get on the property ladder in two ways. Firstly, by increasing the level at which first-time buyers start paying stamp duty from £300,000 to £425,000.

In addition, the government is allowing first-time buyers to access the relief when they buy a proper-ty costing less than £625,000 rather than the current £500,000.

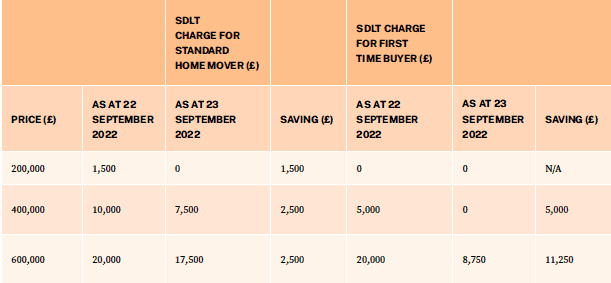

These measures will reduce Stamp Duty Land Tax across the board for all movers by up to £2,500, with first-time buyers able to access up to £8,750 in relief.

How will this help stimulate growth?

Mr Kwarteng announced growth is this government’s top priority and by taking these measures will boost the property market, in turn helping businesses expand to help fuel the wider economy’s growth.

Doubling the nil-rate band will enable up to 29,000 more people to move home each year, in turn boosting household consumption, which will increase confidence in the economy and support thou-sands of businesses that rely on the property market. This includes, for example, estate agents, cleaners, builders, contractors, removals companies, plumbers, decorators and others.

‘This policy’, the Chancellor said, ’is a tax-cut for hard-working people and will allow them to keep more of the money they earn. This tax cut will boost household consumption, increase economic confidence and support jobs.

‘The government is committed to fiscal sustainability by ensuring the economy grows faster than our debts and keeping debt as a proportion of our economy on a downward path.’

How is the government helping first-time buyers?

For a first-time buyer, the expenses that come with buying a new home can be off-putting. To help them, Mr Kwarteng announced the government is raising the amount they can spend on a new house without paying any Stamp Duty Land Tax.

The nil-rate threshold will be raised from £300,000 to £425,000. The government is also increasing the maximum property purchase price which will qualify for First-Time Buyers’ Relief from £500,000 to £625,000.

Table of Potential Stamp Duty Land Tax Savings

Case Studies

Case studies

Case study 1 – first-time buyer in London

Average London house price (Land Registry Data July 2022) – £543,500

Original SDLT bill – £17,175 (first-time buyers wouldn’t have been eligible for First-Time Buyer’s Re-lief under the old system)

New SDLT bill – £5,925

Saving is £11,250 (-65%) (£2,500 due to nil-rate band up to £250k and £8,750 due to First Time Buyer’s Relief changes)

Case study 2 – standard home mover

Average England House Price (Land Registry Data July 2022) – £312,000

Current SDLT bill – £5,600

New SDLT bill – £3,100

Saving is £2,500 (-45% of original bill)

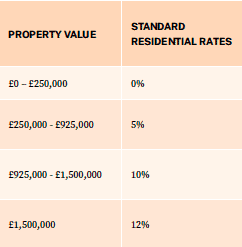

Background on Stamp Duty Land Tax

Stamp Duty Land Tax (SDLT) is a tax you pay whenever you purchase a house in England or Northern Ireland.

Different rates of SDLT are paid on properties depending on their price once they pass a threshold, which from today will be £250,000.

Standard Residential SDLT rates from 23 September 2022

The Higher Rates on Additional Dwellings apply to purchases of additional properties and are three percentage points above standard residential rates.

The Non-Resident surcharge applies to purchases of residential property by non-UK residents and is two percentage points above standard residential rates.

This is a permanent measure and will apply only in England and Northern Ireland. Stamp duty is not charged in Scotland; instead home purchasers pay Land and Buildings Transaction Tax, with rates set by the Scottish Government. Stamp Duty is also not charged in Wales, where purchasers pay Land Transaction Tax, with rates set by the Welsh Government.

Related Articles

Cost of Living Crunch

Housing market predictions

Invest your way out of inflation

What should I do if I am struggling to pay my mortgage?

Wealth vs Health